At the core of BiG's identity is our commitment to democratizing access to high-quality, affordable insurance coverage while creating an ownership ecosystem for our agents. We operate with a clear mission focused on innovation and empowerment, guided by these fundamental principles:

We believe that comprehensive insurance coverage should be accessible to everyone. Our dedicated team of professionals works diligently to ensure that each client receives personalized guidance through the insurance process, emphasizing education, transparency, and protection tailored to individual circumstances.

BiG leverages cutting-edge technology to deliver a diverse portfolio of insurance solutions designed for today's evolving needs. By combining real-world asset protection with blockchain innovation, we've created a scalable, decentralized platform that rewards performance with equity. Our comprehensive suite includes health, life, accident, and critical illness coverage, all supported by licensed professionals with extensive industry knowledge and backed by our proprietary token-based rewards system that aligns incentives with company growth.

We have deliberately constructed an environment where insurance professionals can achieve unprecedented success and build lasting wealth. By fostering collaboration, providing advanced training, and implementing our innovative tokenized compensation structure, we equip our agents with the resources needed to build sustainable careers while making meaningful impacts in their clients' lives. This isn't just about commissions—it's about giving agents true ownership and a stake in the company's growth and future.

Values-Driven Organization

Our organisational culture is built upon unwavering commitment to integrity, exceptional service, and operational excellence. These core values guide every decision we make, from product development to client interactions, creating a foundation of trust that defines the BiG experience for both clients and team members alike.

As we continue to expand our presence in the insurance market, BiG remains dedicated to our founding vision: creating a more secure future for both clients and agents. We're building more than wealth— we're building legacies, lifting families, and ensuring no one gets left behind. This whitepaper details our groundbreaking tokenised rewards system that represents the future of the insurance industry: where protection meets possibility, ownership meets opportunity, and everyone has a chance to secure their future.

EXECUTIVE SUMMARY

BiG Agency (BiG) introduces the Bigganos Token (BIG), a revolutionary utility token designed to create a transparent, efficient, and incentivised ecosystem for insurance contractors.

This whitepaper outlines the token"s structure, distribution mechanics, and governance framework that aims to align the interests of contractors with the company"s long-term success. Through innovative smart contract technology, BIG enables automated rewards distribution, secure token-to-USDC exchange at fixed rates, and transparent performance tracking.

The system incorporates industry-standard security measures and provides contractors with both immediate benefits and long-term incentives through its vesting mechanism. BiG Agency is an American company and the Bigganos (BIG) token platform is an American project.

Introduction

BiG Agency (BiG) introduces the Bigganos Token (BIG), a revolutionary utility token designed to create a transparent, efficient, and incentivised ecosystem for insurance contractors.

This whitepaper outlines the token"s structure, distribution mechanics, and governance framework that aims to align the interests of contractors with the company"s long-term success. Through innovative smart contract technology, BIG enables automated rewards distribution, secure token-to-USDC exchange at fixed rates, and transparent performance tracking.

The system incorporates industry-standard security measures and provides contractors with both immediate benefits and long-term incentives through its vesting mechanism. BiG Agency is an American company and the Bigganos (BIG) token platform is an American project.

The Bigganos Token (BIG) serves as a utility token within the BiG Agency ecosystem, primarily designed to

Core Token Contract (BiG.sol)

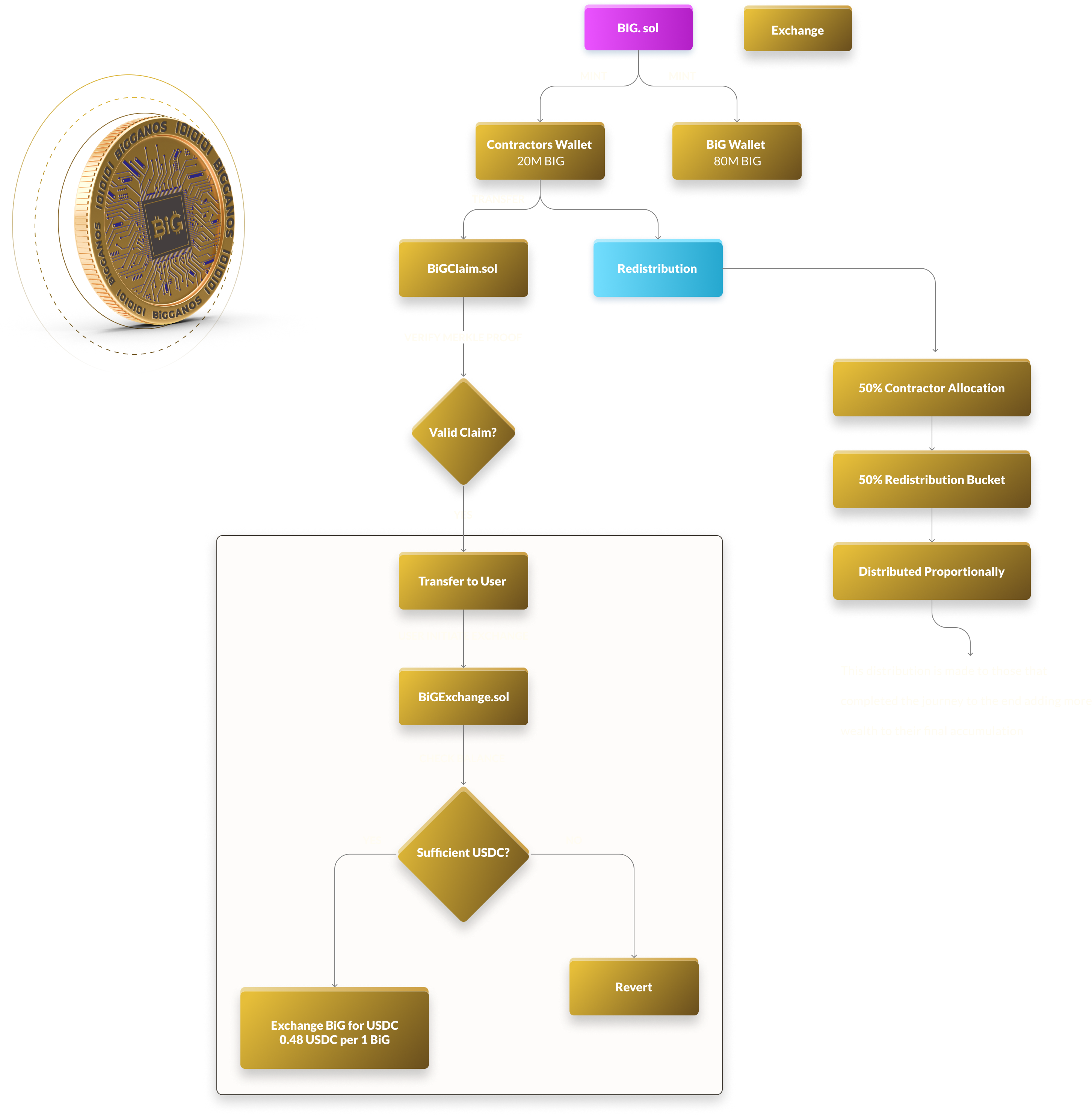

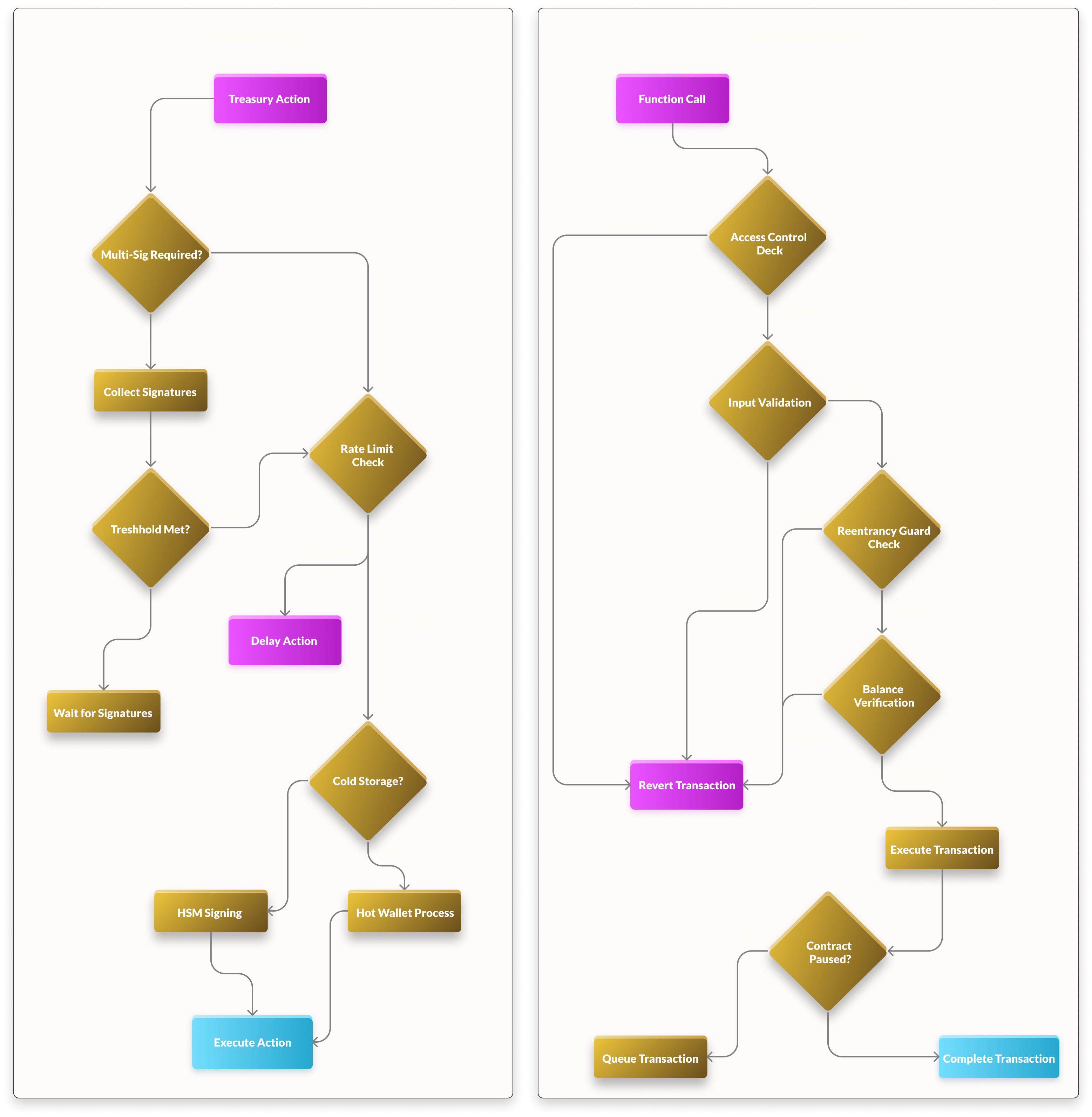

The following diagram illustrates the interaction between the three main contracts:

The Bigganos Token (BiG) provides contractors with multiple benefits designed to reward both short-term performance and long-term commitment. Through its innovative vesting mechanism, token holders can earn additional rewards while maintaining flexibility in their token management.

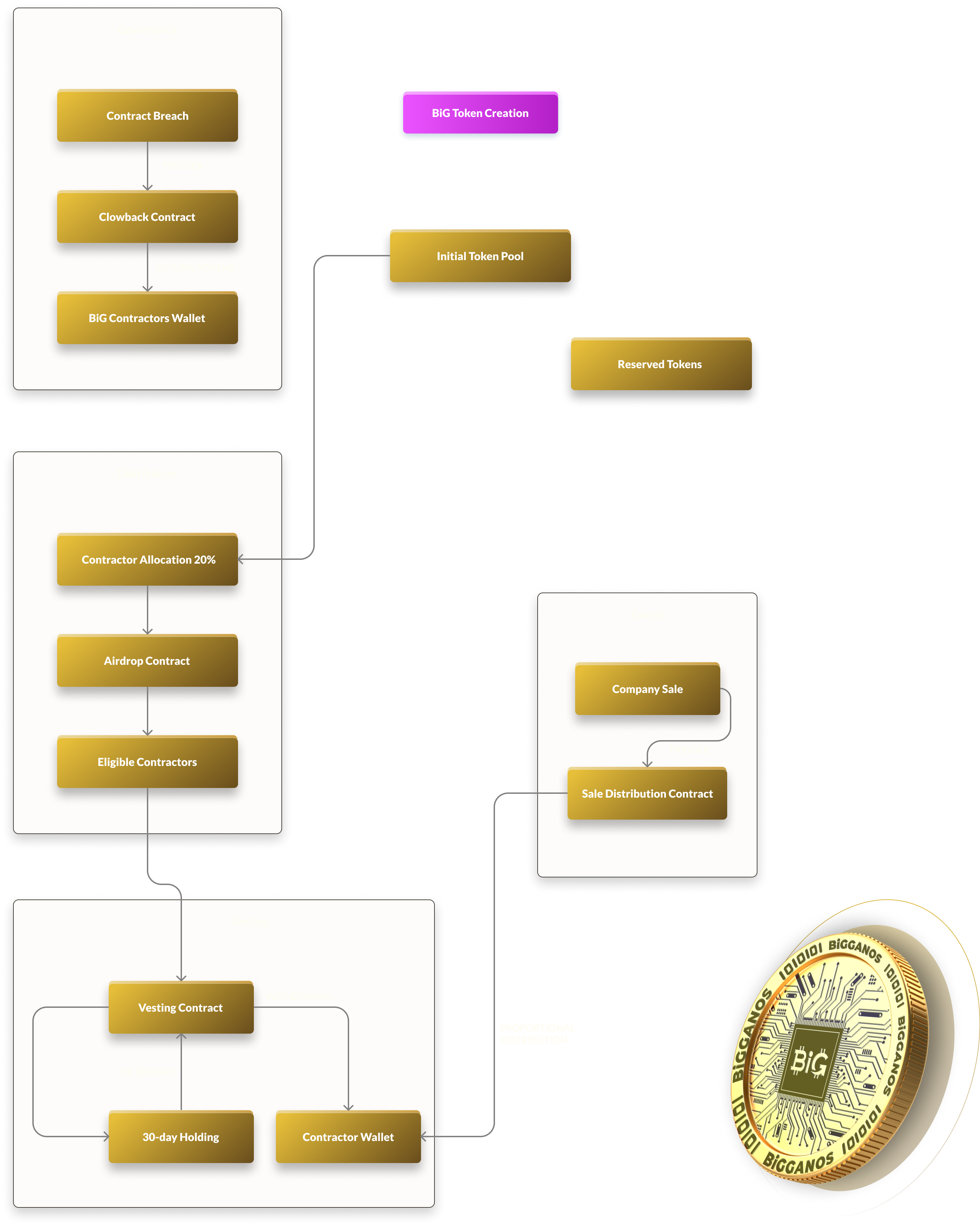

Vesting Properties

Vesting Process

In the event of a company sale or acquisition, the Bigganos Token incorporates specific rights for token holders, ensuring their interests are protected during such transactions.

Key Rights

Distribution Process:

Note: This section includes additional details regarding:

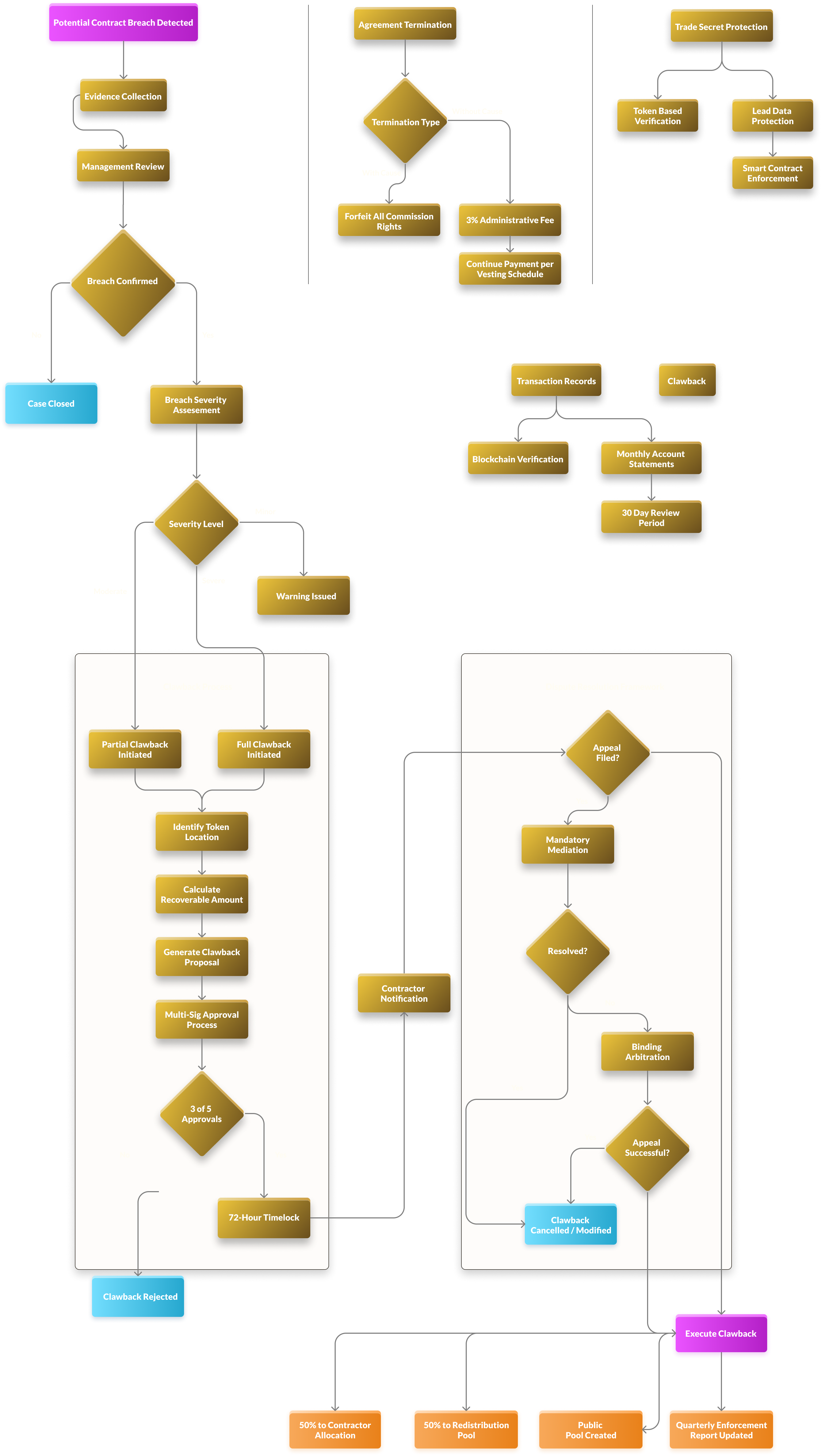

The Bigganos Token ecosystem incorporates robust governance mechanisms to protect both the company and compliant contractors while maintaining system integrity.

The token system includes sophisticated provisions to safeguard against contract violations and misuse:

The Bigganos Token ecosystem incorporates additional governance mechanisms to ensure efficient operation and fair resolution of conflicts:

The Bigganos Token ecosystem incorporates robust governance mechanisms to protect both the company and compliant contractors while maintaining system integrity.

Access Methodology

Our internal security process utilised two complementary static analysis frameworks:

Key Findings

Each contract was analyzed using both tools to provide multi-faceted coverage of potential security concerns.

Security Assurance Statement

Independent third-party audits from recognised security firms

Formal verification of critical contract functions

Bug bounty programs to leverage community expertise

Continuous monitoring and testing throughout development

The clean results from our preliminary analyses using both Slither and Mythril provide strong confidence in our contract architecture"s security foundations. These complementary tools offer different approaches to security analysis—with Slither focusing on known vulnerability patterns and Mythril employing symbolic execution for deeper analysis—providing more comprehensive coverage than either tool alone. All audit reports will be made publicly available as they are completed to maintain transparency with our community.

"While the Bigganos Token ecosystem implements comprehensive security measures, no blockchain system can claim to be entirely immune to attacks. We maintain ongoing security practices, including regular third-party audits by reputable security firms, continuous monitoring, and rapid response capabilities to protect user assets and system integrity."

This document is not a prospectus or solicitation for investment. The BiG Token system is designed as a utility token for contractor rewards and engagement within the BiG Agency ecosystem.

Note: This whitepaper is a living document and subject to updates and revisions as the project evolves